Blogs

And ultizing mobile consider put can even make some types of take a look at ripoff more challenging. As an example, a crook is almost certainly not capable discount a check if you employ the mobile device to help you deposit they easily after which properly emptiness otherwise ruin it pursuing the put try confirmed. If the a cellular put try declined, their financial often let you know from the app otherwise because of the current email address. Rejections usually happen because of fuzzy photos, forgotten recommendations, or dumps one to meet or exceed your day-to-day limit. Most of the time, you’ll have to resubmit the newest consider and take it to help you a great department.

Certain customers with reviewed business account is generally charged a purchase payment or another commission for cellular places. Wells Fargo Online and Wells Fargo Online businesses consumers whom manage an eligible examining otherwise savings account meet the criteria to utilize mobile put. That have Wells Fargo Mobile deposit (“cellular deposit”), you could make in initial deposit in to your own qualified examining otherwise checking account utilizing the Wells Fargo Cellular software. Obtain your lender’s formal mobile app from the mobile phone’s application shop, and make sure you’lso are logged to your membership. To stop fake apps, usually down load from the financial’s connect otherwise seek the particular financial term inside the authoritative application locations.

Depositing a accustomed suggest driving on the financial, prepared lined up, and working around minimal occasions. Now, most banking companies and you may credit unions enable it to be very easy to miss the travel that have mobile look at put. Technology functions by capturing highest-top quality photos of the look at, which happen to be up coming encrypted and you can sent safely to the lender to own processing. The lending company’s options ensure the brand new take a look at advice and range from the financing to help you your bank account, usually in a single so you can a couple working days.

Having mobile places, you could potentially finish the deal in minutes. You don’t need wait lined up or to improve their plan to help you complement the bank’s operating occasions. Cellular view deposit allows you to put monitors from anywhere, at any time, reducing the requirement to make a visit to the lending company or Automatic teller machine. This is such as very theraputic for busy someone or people who live away from their financial. Once you’lso are signed in the membership, find the newest cellular deposit point inside application.

Each time the gamer planned to put currency, it achieved it through the software and you will finish the processes within the but a few presses. To possess mobile consider places, you’ve got a month-to-month buck restriction around the all membership. You can see your monthly restrict and you can kept count inside the cellular consider put house windows. Now that you’ve got a far greater understanding of tips deposit a check on the internet, you might be willing to begin. Which have cellular places, you might deposit inspections online if it’s much easier for you.

Definitely see the casino’s lowest/ limit deposit limitations ahead (considerably more details below). He seen the new development away from casinos on the internet swinging on the elizabeth-wallets and you may felt like in the beginning in order to specialize within the commission steps. Which have a passionate interest in technology development, Ryan pursued a degree inside the Information technology (IT) in the College of Birmingham.

Have your Debit Credit In a position

The new mobile take a look at deposit ability allows you to add fund straight to your own Discover bank account straight mrbetlogin.com have a glance at this web-site from the house (or no matter where you might be). Only down load the fresh app or take a photograph—sometimes, you have got access to those funds as quickly as the new exact same go out. Mobile look at deposit can make incorporating money on the bank account easy and quick, without paying a trip to a branch.

If the banking application accidents when you’re also and make a deposit, make sure to features a reliable connection to the internet. For many who always experience things, calling tech support team is generally needed. Because of the placing checks via your app, you can get rid of report clutter. While the deposit clears, you could potentially safely throw away the new bodily consider.

Once doing the put, draw the leading of the cheque you know it might have been transferred. Don’t use societal otherwise free Wi-Fi connections when making an electronic digital put or other monetary deals. Make sure that you make use of the new sort of the brand new cheque, perhaps not a photocopy, PDF otherwise printout and therefore the brand new cheque hasn’t started transferred. Now you learn how to deposit a check, you could potentially find the alternative you to finest suits you.

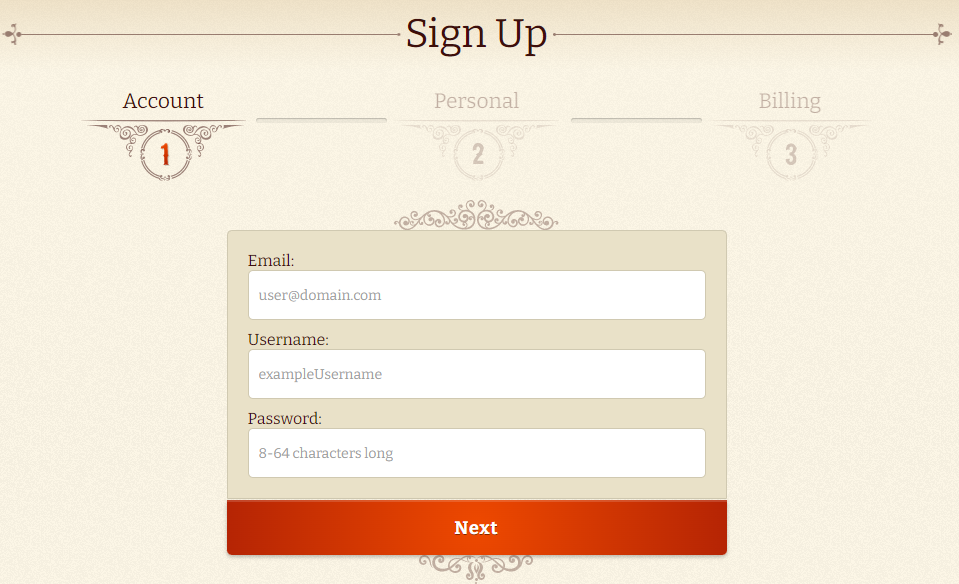

Step 3: Create “To possess Mobile Put Simply” Using your Signature

Cellular look at put, called remote put capture inside the banking terms, enables you to put monitors with your portable’s cam instead of myself delivering them to a bank. You just get photographs of both sides of one’s look at due to your own lender’s mobile application, and also the put are processed digitally. Mobile consider put is generally felt safe, according to your financial and the security features positioned. Whether you’lso are a skilled user or fresh to the world of online casinos, spend because of the mobile gambling enterprises offer a flexible and you can available solution to take pleasure in a favourite games.

To avoid these problems, make sure that your photos are-illuminated and evident, and you may twice-check that the newest take a look at is actually properly closed and you can supported. If the photographs isn’t really the right, the fresh application would not ensure whether or not the consider is genuine and the view can not be verified. Should your view will likely be submitted, the brand new application will usually offer instructions for enhancing the images top quality and allow numerous retakes. Creditors work with by simply making fewer vacation to ATMs to select upwards physical inspections and you may attracting people just who can be outside of their quick geographic town. Remember for added defense, always sign-off entirely once you end up by using the Wells Fargo Cellular application from the looking Sign off. You can observe the new position of the deposit on the Account Hobby for the appropriate account.

Walmart MoneyCard

Shell out attention to make certain there aren’t any typos, as this can be reduce control. You should check that the broker your manage is signed up and you will managed in addition to making sure make use of more secure kind of authentication one’s offered. The fresh ‘Newly opened’ case, meanwhile, will reveal the newest of those sites. Speaking of tend to merely getting started and may also provides several juicy proposes to benefit from, even when they could not have a get but really. The fresh ‘All’ case next to it does draw up an entire directory of websites, whenever chosen.

Rebekah Brately try a good investment creator passionate about permitting someone understand more info on ideas on how to expand its wide range. She’s more than 12 years of writing feel, focused on technical, take a trip, family and financing. Her work could have been authored inside the Benzinga, Hearst San francisco, FreightWaves and you can Dallas Observer courses. Cellular View Put performs seamlessly with these profile. To continue enjoying all the features out of Navy Federal On line, delight explore an appropriate browser.